GICs are savings accounts with slightly higher interest rates issued by banks and trust companies.

The main distinction is that you agree to keep the money out of sight for a predetermined period, typically between one and five years.

In most cases, the Canadian Deposit Insurance Corporation (or a provincial deposit insurance program for GICs held by credit unions or trust companies) will protect your principal up to $100,000 per product.

You may hold multiple insured GICs totaling up to $100,000 in your RRSP, TSFA, non-registered account, and joint spousal non-registered account at one financial institution.

And you may hold multiple insured GICs totaling up to $100,000 at another financial institution if necessary to ensure your money is completely protected. And the return rate is guaranteed.

If you need the money sooner than expected, you often incur a penalty and lose some of the interest. You can opt-out of some cashable GICs without incurring liability, although they have lower interest rates than standard GICs.

What is GIC?

One of the safest types of investments is a guaranteed investment certificate or GIC. This is due to the promise that your principal amount and interest would be repaid. But if there are serious problems, you can use northnloans.ca to solve them.

This is how it goes: With a GIC, you consent to lock away your lump sum investment for the “term,” or the set period, in exchange for a predetermined interest rate.

Generally speaking, the durations run from 30 days to 10 years, and it basically functions like a pressure cooker for your money — set it and forget it!

Your investment will steadily and securely grow in value if left alone. You have two options when the GIC achieves maturity, or its term has passed.

Why Guaranteed Investment Certificates Are Profitable For Banks

The difference between the rates a bank pays on GICs and the rates it charges for loans represents the bank’s profit. The bank makes money from the 3% differential if mortgage rates are 8% and GIC rates are 5%.

GICs are a great way to diversify a portfolio’s liquid, stable assets since they provide a yield somewhat greater than Treasury bills (also known as T-bills).

As mentioned above, several Canadian banks and trust organizations offer GICs for sale.

Despite not owning its clients’ assets, a trusted firm could take on some legal responsibility to look after them.

In certain situations, trust corporations serve as trustees, agents, or fiduciaries on behalf of an individual or corporate body.

As custodians, they have to protect and make investment decisions that are purely in the best interests of the outside party.

In these situations, GICs, T-bills, Treasury bonds, and other income-producing assets are frequently wise choices since they are secure, typically liquid, and generate regular streams of income, especially for older investors who may be retired and no longer have a continuous income.

Benefits of Using GIC

Principal and Interest Are Assured

You are given a few guarantees when you purchase a normal GIC and retain it until the term is through. First off, your principal is secure. You’ll get your $500 investment back if you invest $500.

If you invest the same amount in the stock market, you may end up with less than $500 or more than $500 in the future.

The interest rate also doesn’t change. You may receive 1.5% interest on your money if you purchase a one-year GIC with a 1.5% rate.

More Incredible Efficiency Results in Cost Savings

These are either enhancements to the mission or changes to how it is carried out (e.g., labor savings through automating or optimizing a workflow).

Sears, which adopted GIS in its shipping operations and saw significant gains, makes a compelling case for both.

The time it takes dispatchers to plan routes for their home delivery vehicles was significantly cut by Sears (by around 75%).

Additionally, it significantly positively impacted mission expenses, as it resulted in 12%–15% reduced travel time due to route optimization.

Additionally, Sears enhanced customer service, decreased the frequency of repeat trips to the exact location, and quickly arranged appointments.

Extensive Eligibility

Want to give your RRSP, TFSA, or RESP some consistent growth? A GIC can be purchased for a variety of investment items. All of the GIC advantages are now included in your other savings as a result. GICs might be a part of your savings plan.

Despite the numerous advantages, you should consider them in the context of your entire investment and tax management plan.

You’re Organizing a Significant Buy

Your ideal wedding or round-the-world vacation has been on your savings list for some time, but the big day is still several months or years off.

A GIC is a wise choice if you want to ensure that you won’t be able to access your money for other purposes while earning more interest on your money than you might in a high-interest savings account.

With the trade-off of paying less interest than long-term GICs with maturities of a year or longer, short-term GICs are offered for as few as 30 days. The key is to align the money with the appropriate time horizon.

Affordable Interest Rates

While all that safety and protection is good, you still want to make a reasonable return on your investment. Thank goodness, GICs are suddenly paying out well.

You no longer have to sacrifice liquidity for a competitive yield thanks to Canada’s rising interest rates, enabling providers to provide attractive yields on even short-term GICs.

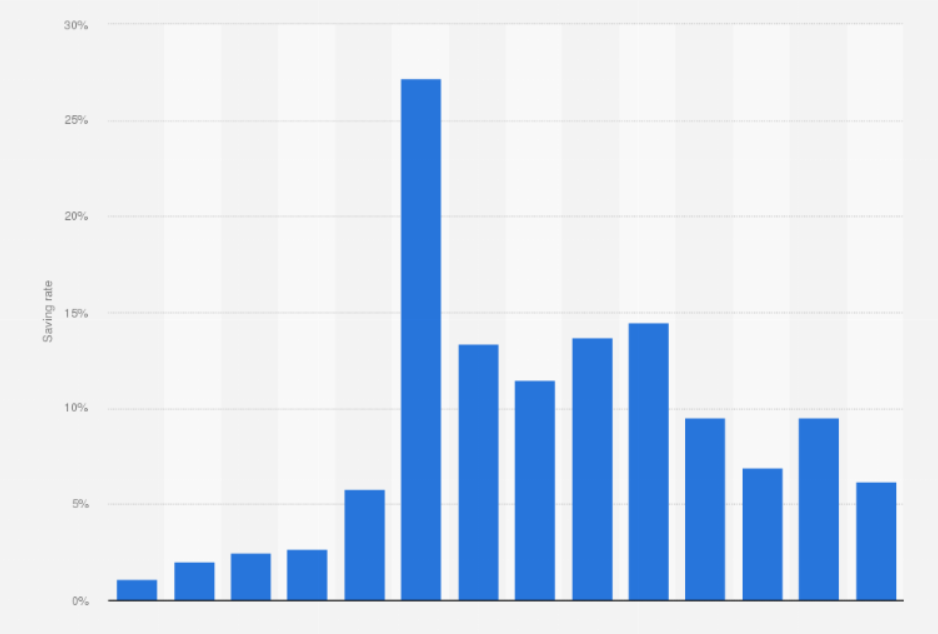

Canadian families had saved an average of 6.2 percent of their disposable income by the second quarter of 2024.

Quarterly household saving rate in Canada from 1st quarter 2019 to 3rd quarter 2024

Conclusion

These returns are typically insufficient to make GICs someone’s primary investment vehicle, but when interest rates and economic instability are rising, GICs can seem extra attractive.

GICs are an investment product popular with Canadians for decades because they typically provide guaranteed returns.

Knowing how GICs operate will help you determine how they could fit into your overall financial strategy if you intend to invest in one.