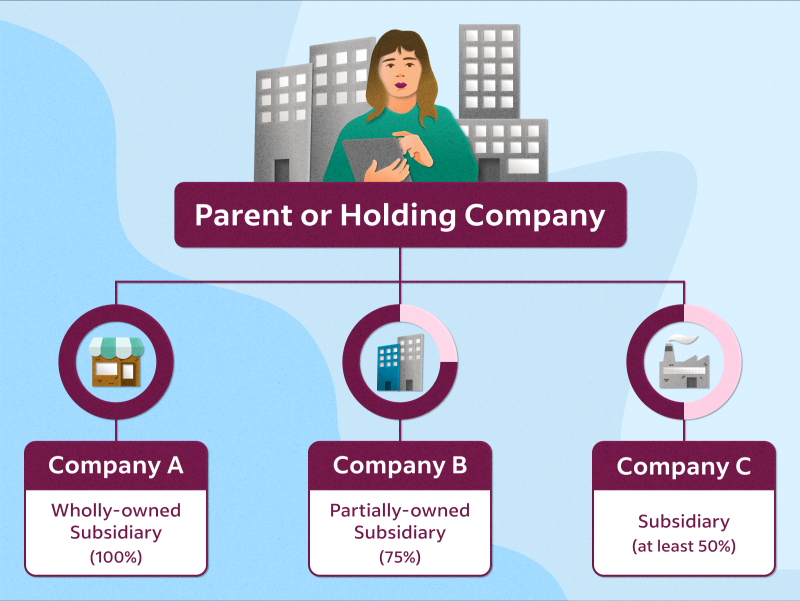

A holding company is an organization that holds controlling interests in several subsidiary companies. A ‘controlling interest’ does not have to mean majority shareholding.

If company shares are distributed between many small shareholders, 20% or 30% of shares owned by a single company is going to be a controlling interest.

In simple words, a holding company acts as a ‘parent’ company for its subsidiaries.

How holding companies come into existence?

The two key methods are merger and acquisition. A company can buy a controlling interest in another company and thus become a holding.

However, there are some other methods of forming a holding company too. These include the following ones:

1. Internal restructuring

A conglomerate can restructure and make one of the member companies a parent company making all other companies its subsidiaries.

2. A buyout

Managers of a large company can buy out other companies and consolidate the previously existing and the newly purchased property.

3. Privatization

State-owned assets are sometimes sold to private investors. Such assets can be consolidated in a holding company.

4. Family business

Large business groups owned by billionaires often take the form of holdings. This helps them keep their families in control.

5. Conglomerates

A conglomerate is a group of independent companies. However, the companies can be united and start performing business operations under a common flag.

6. Investments in private equity

A group of investors can buy out several companies and then add them to their existing holding company or create a new holding.

Advantages and disadvantages of holding companies

The main benefits that holding companies offer include the following ones:

- Product sales optimization.

- Simplification of purchasing processes.

- Improvement of interaction between subsidiary companies within the holding company.

- More financial opportunities including access to loans.

- The use of a holding company for asset protection purposes is one of the most widespread uses of such a company.

The main disadvantages of a holding company include the following ones:

- Compiling consolidated financial reports is a difficult task.

- Complexity of centralized regulation of labor relations: labor laws are different in different countries while subsidiary companies can be scattered all around the globe.

- Close monitoring on the part of the regulators, the top managers, and sometimes company shareholders. Each serious operation of the group is scrutinized.

- Lack of competition: subsidiary companies do not have to compete with each other. This can make them more relaxed and less efficient. They have no incentives to introduce innovative technologies and refine their operational procedures. As a result, the overall profit of the holding company may reduce in the long-term perspective.

- Additional management resources are required. You need more people, paperwork, and money to manage several companies at a time. In other words, your operational costs are going to be higher. Besides, coordinating the activities of the subsidiary companies within a holding can also be challenging. Delays in decision making processes as well as business processes may occur.

- Tax-related difficulties. Depending on the country where your holding is registered, you may run into trouble when compiling fiscal reports. Sometimes the profits of subsidiary companies within a holding can be redistributed only to a certain degree. Tax planning for several companies at a time is another challenging task.

Specifics of holding company operations

One of the main features of a holding company is the fact that management operations are centralized.

The holding company makes strategic decisions that have to be implemented by the subsidiary companies. It also sets long-term goals and objectives.

In addition, the holding company distributes capital, funds, assets, and technological and human resources between the subsidiary companies.

The holding also monitors the operational and financial indicators of the subsidiary companies on a regular basis. It formulates different policies for the subsidiaries including financial, fiscal, risk management, personal management, and other policies.

There are three more factors that you should not forget about:

- The holding company is responsible for investment planning.

- The holding company is responsible for distributing the profits between the subsidiaries: the profits made by the subsidiaries are accumulated in the holding via payment of dividends.

- The compliance management has to be conducted at all times. The holding company has to make sure that all subsidiaries observe various laws and regulations.

Types of holdings

Holdings can be broken into types by four different criteria.

1. By the control method:

- Formal control – the holding owns more than 50% of the shares of each subsidiary. This gives it full control over all aspects of business.

- Informal control – the holding owns less than 50% of the shares of each subsidiary but it can make an impact on the management of each company.

2. By the functions of the parent company:

- Financial – the holding makes only strategic investments and does not manage the subsidiary companies.

- Industrial – the holding takes an active part in the management of the subsidiary companies.

3. By industrial relations between subsidiaries:

- Horizontal – the subsidiaries manufacture analogous or related products.

- Vertical – each subsidiary contributes to a certain stage in the overall production process.

4. By the degree of mutual impact:

- Fully dependent subsidiaries – the holding dictates how each subsidiary has to work.

- A conglomerate of companies – each subsidiary works autonomously.

How to start a holding company

The process of creating a holding involves the following steps:

- A company buys controlling interests in several other companies.

- It provides strategic management, distributes resources, and controls the operations of all subsidiaries.

- The subsidiaries work independently but in a coordinated manner.

- The holding obtains profits in the form of dividends paid by the subsidiaries.

How to grow your holding company

You have to do the following things to grow and develop your holding:

- Determine the key industries where you want to work.

- Buy a controlling interest in a relevant company.

- Raise initial capital (attract investors, apply for grants, etc.).

- Create a holding company that has to be a separate legal entity.

- Define the key management principles.

- Strive for synergy by centralizing main management functions.

- Attract highly-qualified company managers.

- Keep reinvesting the profits and buying new companies.

Widespread mistakes in holding company management

- Mistake №1: too much bureaucracy due to excessive centralization.

Solution: decentralize company management and delegate more authorities to the subsidiary companies.

- Mistake №2: allowing significant discrepancies in the performance of different subsidiaries.

Solution: work out common policies and strategies for all subsidiaries.

- Mistake №3: too little freedom for subsidiary companies.

Solution: stop micromanaging and hire professional managers for subsidiaries.

- Mistake №4: allowing conflicts of goals between managers of the holding.

Solution: Define the top priorities and set common goals for all company managers.

- Mistake №5: inefficient distribution of resources.

Solution: give more planning power to the subsidiary companies.

Some of these mistakes may appear not so easy to correct. Well, you have to be creative in managing such a complex business structure as a holding company.